Potential Source for Sustainable Investment Opportunities!

The greatest potential for economic growth and investment in Somalia lies in the agriculture sector. This includes crop, livestock and forestry. Despite the constraints it faces, this sector has viable opportunities for investment. It’s potential to contribute to sustained economic growth stems from a number of factors such as: rich natural resource capital, demonstrated potential to capture larger elements of the value chain than other sectors, opportunities for increased value addition, good profit margins, and the availability of market opportunities.

The main principal export crops grown include bananas, lemons, and sesame.

Basic information on agriculture and livestock markets, firms, technologies and consumers are scarce. Information on macroeconomic aggregates is also hard to come by. In the absence of government institutions the national economic and statistical infrastructure has collapsed. In the current condition of the country, the private structures that would normally offer market research services are not available.

In 2015, the Somali Agriculture Technical Group (SATG) has conducted comprehensive research studies to understand the production, input supply, marketing, processing and export of agriculture value chains in Somalia. There has been a focus on bananas, lemons, sesame and dairy. The outcome of these studies highlights the great potential for business and investment opportunities in Somalia.

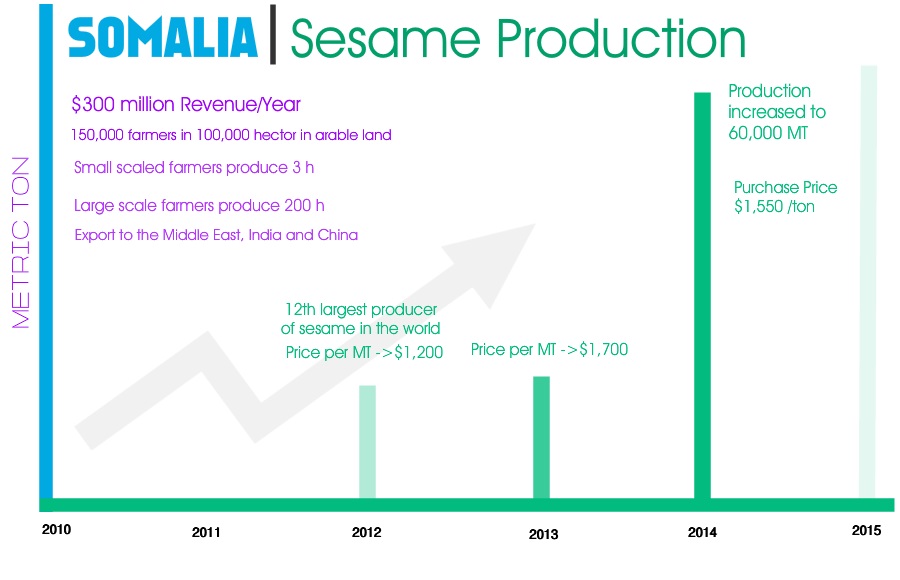

Sesame Investment Opportunity

Somalia is one of the few countries in the world where sesame is grown as a traditional crop. The crop is generally grown during the Deyr growing season (October to December) using traditional methods of both rain fed and flood irrigation systems. A short rainy season (Deyr) followed by a dry season (Jilaal) is ideal for crop production, sun drying, processing and packaging. Pests and disease incidences are minimal when crop is grown during the short rainy season.

Despite the civil unrest and recurrent droughts, sesame production has been thriving. There has been a nearly seven-fold production increase from 1991 to 2014

This is a clear indication that sesame is a resilient crop that can be transformed into a vibrant business with formidable economic benefits.

The studies conducted by SATG clearly suggest that there are investment and business opportunities in all segments of the sesame value chain that can transform the lives of many, while sustaining a profit gain by investors.

Sectoral Opportunities

Input and Production

The grain production per unit area is very low, averaging about 0.3 MT per hectare. This is due to the lack of good quality seed varieties and poor use of Good Agricultural Practices (GAP). The lack to good quality seed provides an excellent opportunity for the establishment of a sesame seed industry that introduces new and improved seed varieties that address the seed purity issues. This will enable growers to compete with the international markets and fetch far better seed prices.

Sesame Seed Micro Processing

The sesame oil microprocessors are paying a high price for repair and maintenance of the processing machines as these are old type machines. The capacity of the machinery is also very low.

There is an investment opportunity to introduce high quality sorting/cleaning machines with a high processing capacity to satisfy the market needs. This will also help increase the oil production capacity for local consumption and export while lowering overall maintenance costs.

Sesame seed Cleaning and Sorting

Although some companies have introduced seed cleaning plants, over 90% of the seeds are still sold without cleaning and sorting.

There is a need for an improved sesame seed cleaning and sorting in order to create more value addition that fetches higher selling prices and therefore higher profits.

Marketing and Financial Services

Ninety percent of the sesame business is financed through farmer-own savings. Some sesame farmers receive contributions from family members and a small amount of investment comes from local investors. Neither loans nor credit are used as a form of investment.

There is a potential opportunity for financial institutions and investors to come forward and invest in the various levels of the sesame value chain (from production to marketing) in order to make the sector more viable and competitive.

Sesame Fact Sheet:

|

Other Related Topics

Rethinking Humanitarian Aid in Somalia: From Dependency to Sustainable Solutions

The Stop-Work-Order imposed by the Trump administration in January 2025 is a wakeup call to many developing countries including Somalia. Since the early sixties, the United States Agency for International Development (USAID) has been a significant contributor to...

USAID Stop-Work Order and Its Impact on SATG’s Agricultural Initiatives

The USAID Stop-Work Order has disrupted key agricultural initiatives in Somalia, including SATG’s involvement in the Inclusive Resilience in Somalia (IRiS) program. Despite significant progress in strengthening the agricultural sector, the halt to operations poses challenges. SATG remains committed to advancing sustainable development in Somalia’s agriculture and will continue to seek opportunities for growth and resilience.

Aragsan: A Game-Changing Mung Bean Variety for Somali Farmers

We are delighted to share a momentous development in the agricultural landscape of Somalia, particularly for farmers dedicated to the cultivation of Mung bean. In a collaborative effort between the Somali Agricultural Technology Group (SATG) and its affiliated...

Recent Comments